Daley company prepared the following aging of receivables – Daley Company’s aging of receivables is a crucial financial tool that provides valuable insights into the company’s credit management practices and overall financial health. This analysis categorizes outstanding receivables based on their age, enabling the company to assess the risk of bad debts and implement strategies to improve its receivables management.

The aging profile of Daley Company’s receivables reveals key trends and patterns that can impact the company’s cash flow and profitability. By understanding the implications of the aging profile, Daley Company can make informed decisions to optimize its credit policies, enhance its collections process, and mitigate the risks associated with overdue receivables.

Aging of Receivables Overview

Aging receivables is a critical financial analysis technique that provides valuable insights into a company’s credit management and overall financial health. By categorizing accounts receivable based on their age, companies can assess the risk of uncollectible debts and identify areas for improvement in their collection processes.

Aging receivables can significantly impact a company’s cash flow. Overdue receivables can lead to cash shortages, reduced profitability, and increased financial risk. Conversely, efficient receivables management can improve cash flow, reduce bad debt expense, and enhance the company’s financial stability.

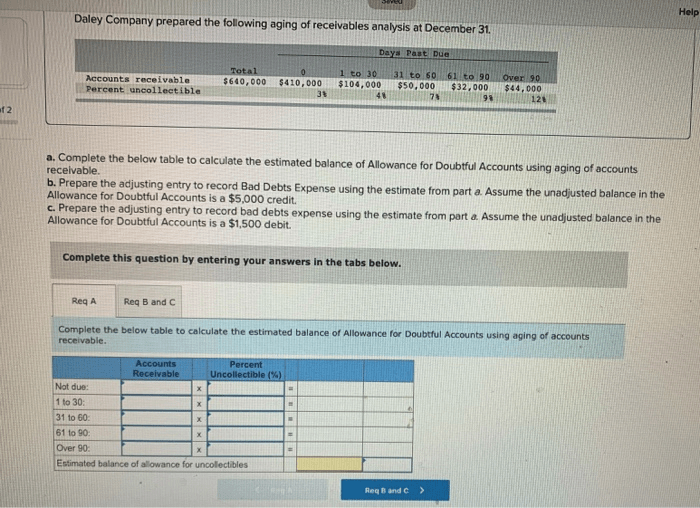

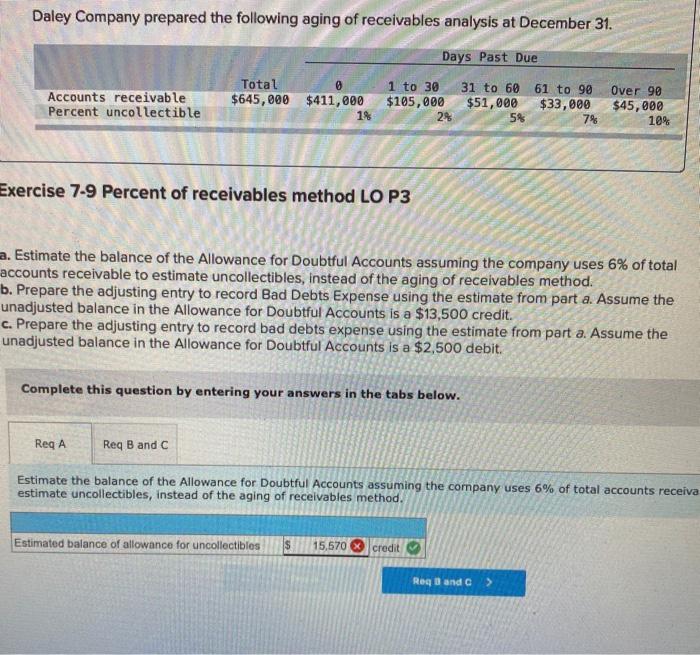

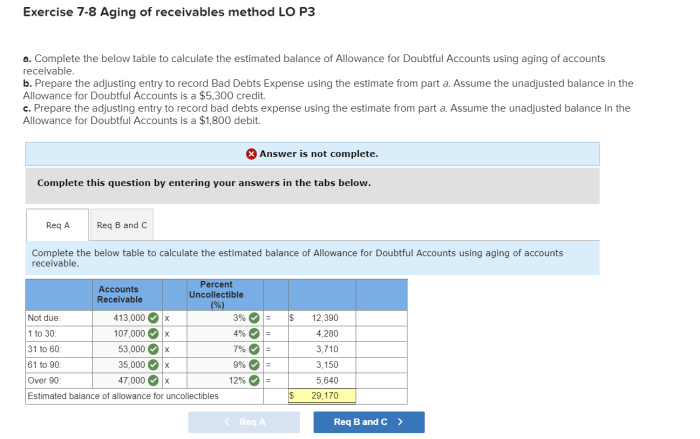

Daley Company’s Aging of Receivables, Daley company prepared the following aging of receivables

The aging of receivables for Daley Company is presented below:

| Age | Amount Receivable |

|---|---|

| Current (0-30 days) | $100,000 |

| 1-60 days | $50,000 |

| 61-90 days | $25,000 |

| Over 90 days | $10,000 |

This aging profile indicates that Daley Company has a significant portion of its receivables (42%) over 60 days old. This may indicate potential issues with credit management and collection processes.

Methods for Analyzing Aging Receivables

Various methods can be used to analyze aging receivables:

- Days Sales Outstanding (DSO):Measures the average number of days it takes a company to collect its receivables. A high DSO may indicate slow collection processes or credit issues.

- Aging Analysis Matrix:Provides a detailed breakdown of receivables by age categories, allowing for more granular analysis of credit risk.

- Customer Concentration Analysis:Identifies customers who account for a large portion of receivables, enabling targeted collection efforts and risk assessment.

Strategies for Improving Receivables Management

Daley Company can implement several strategies to improve its receivables management:

- Establishing Clear Credit Policies:Define clear credit terms, payment deadlines, and consequences for late payments.

- Offering Discounts for Early Payment:Provide incentives for customers to pay early, reducing the risk of overdue receivables.

- Implementing an Effective Collections Process:Establish a systematic process for collecting overdue receivables, including timely reminders, follow-up calls, and legal action if necessary.

Reporting and Monitoring Receivables Performance

To effectively manage receivables, Daley Company should:

- Design a Report Template:Create a standardized report template to present the aging of receivables, DSO, and other relevant metrics.

- Create a Dashboard:Develop a dashboard to monitor key receivables performance metrics, such as average collection period, percentage of overdue receivables, and bad debt expense.

- Establish a Process for Regular Reporting and Analysis:Schedule regular reporting and analysis of receivables data to identify trends, evaluate the effectiveness of collection efforts, and make necessary adjustments.

Key Questions Answered: Daley Company Prepared The Following Aging Of Receivables

What is the purpose of aging receivables?

Aging receivables helps companies assess the creditworthiness of their customers, identify overdue invoices, and estimate the potential for bad debts.

How does aging receivables impact a company’s financial health?

Excessive aging receivables can lead to reduced cash flow, increased bad debts, and impaired financial performance.

What are some strategies for improving receivables management?

Effective strategies include establishing clear credit policies, offering discounts for early payment, and implementing a robust collections process.