Broker P charges a commission of $8.50, a significant fee that can impact investment returns. Understanding the implications of this fee is crucial for investors seeking optimal portfolio performance. This article delves into the concept of commission fees, analyzes their impact on investment returns, and explores alternative fee structures available in the brokerage industry.

Commission Structure: Broker P Charges A Commission Of .50

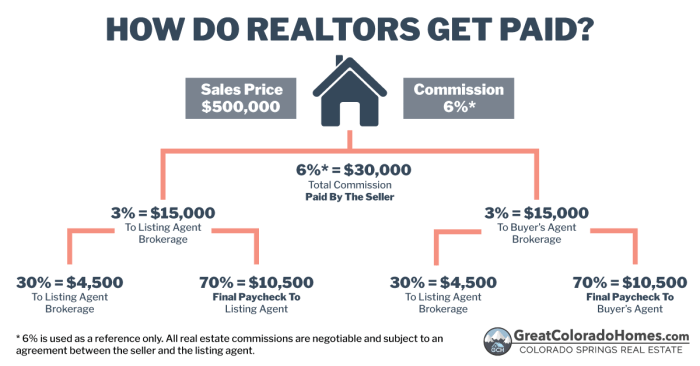

A commission fee is a payment made to a broker for executing a trade on behalf of a client. The commission is typically a percentage of the transaction value, and it is charged by the broker to cover the costs of executing the trade, including research, analysis, and market access.

For example, if a broker charges a commission of $8.50 per trade, and a client places an order to buy 100 shares of a stock at $50 per share, the commission fee would be $8.50. This fee would be added to the total cost of the trade, which would be $5,050 (100 shares x $50 per share + $8.50 commission).

Brokerage Fees

Brokerage fees vary widely depending on the broker, the type of trade, and the size of the trade. Discount brokers typically charge lower fees than full-service brokers, and electronic trading platforms often offer lower fees than traditional brick-and-mortar brokerages.

The typical range of brokerage fees for online stock trades is $0 to $10 per trade, although some brokers may charge higher fees for large trades or complex orders. Full-service brokers typically charge higher fees, which may include a base fee plus a commission based on the size of the trade.

Brokerage fees are not the only fees that investors may have to pay when trading stocks. Other fees may include exchange fees, regulatory fees, and account maintenance fees.

Impact on Investment Returns

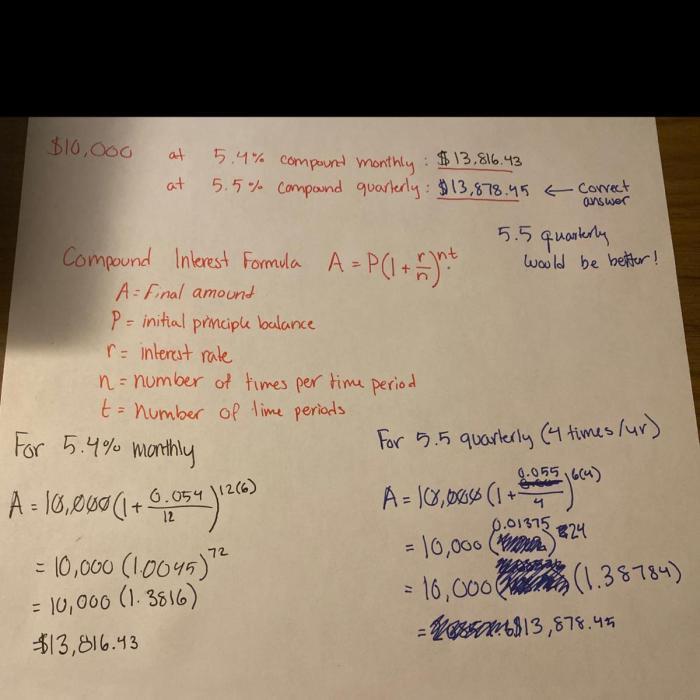

The impact of an $8.50 commission fee on investment returns will depend on the size of the investment, the frequency of trading, and the investment horizon.

For example, if an investor invests $10,000 and places one trade per year, the $8.50 commission fee would represent a 0.085% reduction in the investment return. However, if the investor places 10 trades per year, the commission fee would represent a 0.85% reduction in the investment return.

The following table shows the potential impact of an $8.50 commission fee on investment returns over different time periods:

| Investment Amount | Annual Return | Investment Horizon | Commission Fee | Impact on Investment Return |

|---|---|---|---|---|

| $10,000 | 5% | 1 year | $8.50 | 0.085% |

| $10,000 | 5% | 5 years | $42.50 | 0.425% |

| $10,000 | 5% | 10 years | $85.00 | 0.850% |

Alternative Fee Structures

In addition to commission-based fee structures, brokers may also offer alternative fee structures, such as flat fees or hourly rates.

Flat fees are a fixed fee that is charged regardless of the size or frequency of trades. Hourly rates are a fee that is charged based on the amount of time that the broker spends working on the client’s account.

The pros and cons of each alternative fee structure are as follows:

- Flat feesare simple to understand and can be less expensive than commission-based fee structures for investors who trade infrequently.

- Hourly ratescan be more expensive than commission-based fee structures for investors who trade frequently, but they can be more cost-effective for investors who require a lot of personalized service from their broker.

Impact on Investment Decisions, Broker p charges a commission of .50

An $8.50 commission fee may influence investment decisions in several ways.

For example, investors may be less likely to make small trades if they are concerned about the impact of the commission fee on their investment returns. Investors may also be more likely to hold onto losing positions if they are reluctant to pay the commission fee to sell the stock.

In some cases, investors may even decide to avoid trading altogether if they feel that the commission fees are too high. This can lead to missed investment opportunities and lower investment returns over time.

Top FAQs

What is the rationale behind Broker P’s $8.50 commission fee?

Broker P’s commission fee compensates them for the services they provide, including trade execution, account management, and investment advice.

How does the $8.50 commission fee impact investment returns?

The $8.50 commission fee can reduce investment returns, particularly for small investments or frequent trading. However, it may be justified for larger investments or complex financial strategies.

Are there alternative fee structures available?

Yes, some brokers offer alternative fee structures such as flat fees or hourly rates. These structures may be more suitable for investors with specific needs or preferences.